🔍 Overview of EUR/USD Setup

| Parameter | Value |

|---|---|

| Trading Instrument | EUR/USD |

| Date | April 21, 2025 |

| Chart Momentum | 📈 Bullish (short-term) |

| Potential Direction | 📉 Bearish Reversal |

⚙️ Summary of Key Levels

| Level | Price | Explanation |

|---|---|---|

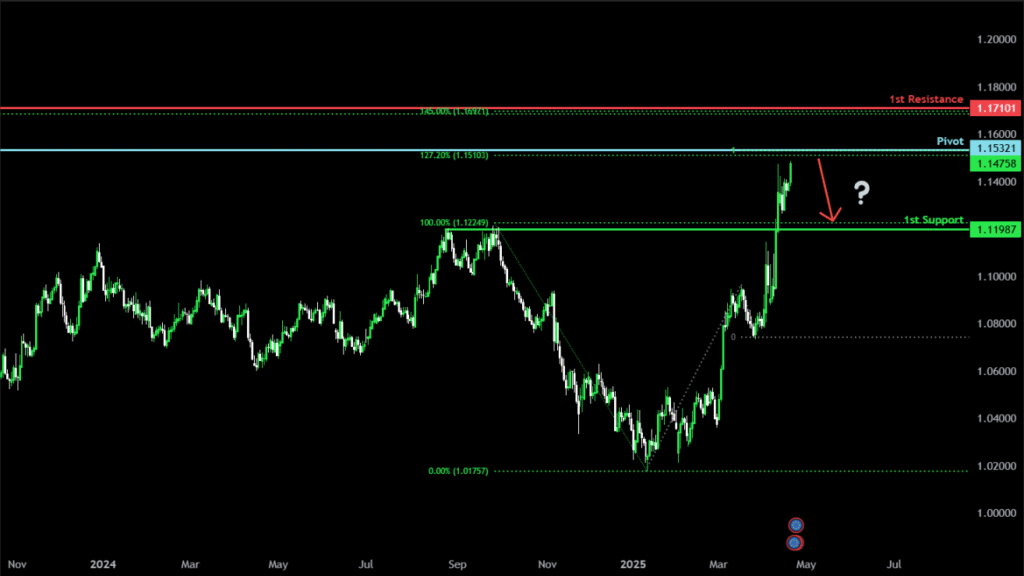

| Pivot Point | 1.1532 | Strong confluence of 100% Fibonacci projection and 127.2% extension – key reversal zone |

| 1st Support | 1.1198 | Pullback support where buyers may attempt stabilization |

| 1st Resistance | 1.1710 | Strong pullback resistance – potential cap to further bullish momentum |

🧠 Market Narrative: Bearish Setup Forming on a Bullish Chart

Despite the short-term bullish trend, the EUR/USD pair is showing signs of bearish exhaustion as it approaches the 1.1532 pivot zone. This level aligns with Fibonacci confluences and is reinforced by waning bullish indicators — signaling the potential for a trend reversal.

This makes it an ideal zone for short sellers to monitor for confirmation patterns.

📈 Technical Indicators & Tools in Play

- Fibonacci Projection & Extension

- 100% projection from previous swing = 1.1532

- 127.2% Fibonacci extension = 1.1532

➤ Strong resistance confluence zone; ideal for bearish entries

- Relative Strength Index (RSI 14)

- RSI currently around 68 on the 4H chart – nearing overbought territory

- MACD (12,26,9)

- Histogram shows fading momentum; potential for crossover below signal line

- Parabolic SAR

- SAR dots still below price – bullish trend active

- Watch for SAR flip above price near pivot for short confirmation

- Stochastic Oscillator

- Overbought > 80; signaling weakening bullish control

- 50 EMA and 200 EMA

- Price trading above both EMAs, but showing divergence slowdown

🔽 Key Technical Levels Explained

🔹 Pivot Zone – 1.1532

- 💡 Bearish Reversal Setup

- 100% Fibonacci projection of the prior bullish leg

- 127.2% extension = exhaustion zone for bulls

- Resistance cluster may trigger institutional selling

- Best Strategy: Wait for a bearish engulfing or shooting star candle at this zone

🔻 Support – 1.1198

- Key pullback support from prior bullish structure

- Buyers may defend this level if price drops post-pivot rejection

- Ideal Take Profit zone for short trades entered near the pivot

🔼 Resistance – 1.1710

- A higher timeframe resistance from 1D chart

- If 1.1532 breaks, price may retest this level before forming the next top

- Confluence with 161.8% Fibonacci extension

🧩 Trading Strategy for EUR/USD – April 2025

| Element | Description |

|---|---|

| Entry Idea | Sell near 1.1532 (with confirmation of rejection candle or SAR flip) |

| Stop Loss | Just above 1.1560 (above rejection wick or SAR dots) |

| Take Profit 1 | 1.1320 – conservative TP at midpoint of support zone |

| Take Profit 2 | 1.1198 – key structural support and main TP target |

| Risk-Reward | Minimum 1:2 ratio recommended |

🧪 Confirmation Checklist Before Entering Short:

- RSI overbought (>70)? ✅

- MACD crossover forming? ✅

- Bearish candlestick at pivot? ✅

- SAR flip happening near 1.1532? ✅

🌐 Fundamental Factors Influencing EUR/USD

- Federal Reserve Policy

- DXY strength may reassert if Fed signals continued tightening

- Higher US Treasury yields attract capital → USD strength → EUR/USD bearish

- ECB Policy Outlook

- If ECB remains dovish on rates, downside pressure on EUR increases

- Geopolitical Concerns in EU

- Risk-off sentiment often favors the USD

- Upcoming Economic Data

- US GDP and Core PCE Index (April 26, 2025)

- Eurozone inflation and ZEW economic sentiment (April 23-25, 2025)

🧭 Watch These Upcoming Events

| Date | Event | Expected Impact |

|---|---|---|

| Apr 23 | Eurozone Flash PMIs | Medium |

| Apr 24 | US Initial Jobless Claims | Medium |

| Apr 25 | German IFO Business Climate | High |

| Apr 26 | US Core PCE Inflation Data | Very High |

| May 1 | ECB Rate Statement | Very High |

⚠️ Volatility Warning: Events could trigger breakout or fakeout near pivot – manage trades accordingly.

📌 Conclusion: Watch 1.1532 – The Battle of Bulls and Bears

EUR/USD is trading in a bullish short-term structure, but macro and technical indicators suggest exhaustion near 1.1532. This zone presents a high-probability reversal setup, especially if confluence aligns with SAR flip, RSI overbought, and MACD crossover.

A clean rejection from this level could lead to a drop toward 1.1198, making this an attractive opportunity for disciplined short trades.